New resource uses sophisticated proprietary algorithm to offer Schwab clients access to dozens of investing themes

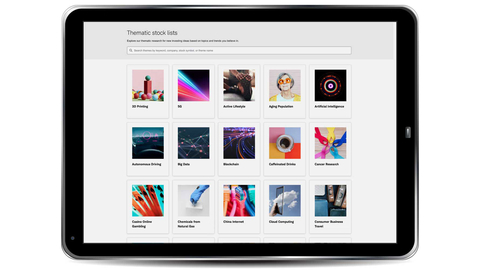

As part of its effort to help clients personalize how they invest, Charles Schwab today announced the launch of thematic stock lists, a new resource designed for self-directed investors who want to invest in stocks aligned with their personal interests and values. Using Schwab’s thematic stock lists – one of the largest theme-based stock list resources available in the industry today – clients can easily view potential investments from a list of 45 different thematic categories and approximately 900 total companies representing a range of trends including data advancement, medical breakthroughs, and environmental innovation. Schwab’s thematic stock lists are available to clients for no additional fee on Schwab.com and the Schwab mobile app.

Top iTechnology Cloud News: 8×8 Introduces Conversation IQ to Bring Consistency and Professionalism for All Employees From the Front Desk to the Back Office

“Individual investors are broadening how they think about investing,” says Divya Krishnan, Schwab product management director. “Nearly a third of our clients today tell us they’re interested in customizing their portfolio to align with themes that are important to them.* Whether it’s an area that speaks to someone’s individual values, or it’s something they have a deep passion for – like space or pets – investors increasingly want the ability to personalize their portfolios.”

Krishnan emphasized, “We expect this investing approach will continue to grow in importance moving forward. This introduction is another step in Schwab’s continued plans to deliver additional personalized experiences to clients with more to come in the future.”

Making thematic stock lists easier and more accessible

While most thematic stock lists available today rely on third-party research sources, Schwab’s thematic stock lists are built using a sophisticated proprietary algorithm. Schwab’s algorithm uses natural language processing (NLP) to mine terabytes of data and millions of public documents, such as patent grants, clinical trials, and regulatory filings to objectively identify publicly traded companies based on their relevance to a particular investment theme. The algorithm can quickly ingest thousands of pages of text and quantify thematic relevance for companies – a task that might take an investor multiple days to accomplish on their own.

Top iTechnology IOT News: Google Adds Dialpad as a Chrome Enterprise Recommended Partner for Both Cloud Communications and Contact Center Solutions

“In recent years, there’s been an explosion of data and better accessibility to information, which can make it overwhelming for investors to manually do their own research to find relevant stocks that align with their personal interests and values,” says Krishnan. “Schwab’s thematic stocks lists put all this information in one place to make it significantly easier for clients to make personalized investment decisions based on ideas or trends that matter to them.”

Schwab’s thematic stock lists take traditional sector research a step further, including companies across multiple sectors and industries that are relevant to a single theme. As a result, investors can view companies by the exposure they offer to a range of prominent current trends, as opposed to simply by sector and size. For example, Schwab’s “Robotic Revolution” thematic stock list includes a variety of companies from across different sectors like industrials, healthcare, and information technology that are building and using robotic solutions for manufacturing, logistics, and medical services.

Top iTechnology Automatoin News: Renesas Releases Next-Generation WPC Qi 1.3-Certified Reference Design for Automotive In-Cabin Wireless Charging

[To share your insights with us, please write to sghosh@martechseries.com]