Corporate data serves as the bedrock for informed decision-making and action, benefiting both management and stakeholders alike. It underpins the management and reporting of critical business issues. Ineffective data yields subpar decisions and outcomes, adhering to the principle: “garbage in, garbage out” (GIGO). Thus, quality inputs are pivotal for effective ESG data management.

Despite being in its nascent stages, the digitalization of sustainability data, including ESG management, is burgeoning. The surge in demand for investment-grade, externally audited ESG data necessitates companies to embrace robust ESG data management practices.

As per Oracle, data management’s objective is to facilitate individuals, entities, and interconnected devices in optimizing data utilization while adhering to policy and regulatory constraints. This empowers them to make decisions and undertake actions that maximize organizational benefits. Effective ESG data management within this framework ensures user trust and confidence in data suitability for its intended use, eliminating the necessity for manual adjustments or data reconciliation.

Why ESG Data Management for Businesses?

70% of investors globally now consider ESG factors in their investment decisions, highlighting the importance of strong data management, in a study by Capital Group. Businesses utilizing ESG data report 25% higher profit margins and 50% greater brand loyalty, showcasing its potential to not only benefit society but also fuel business growth. By tracking environmental, social, and governance metrics, companies can make informed decisions, manage risks, and build trust with stakeholders, ultimately creating a more sustainable and successful future.

The Purpose of ESG Data

The essence of ESG data lies in its ability to serve its intended purpose effectively, ensuring it meets the necessary standards for optimal performance.

Purpose of Business Data: Regardless of its ESG orientation, business data serves several crucial functions:

-

- Performance Measurement: Evaluating business performance on critical issues.

- Performance Analysis: Analyzing performance trends, target achievement, and peer comparisons to guide management decisions.

- Informed Decision-Making: Empowering stakeholders to make well-informed decisions, such as purchasing products or joining a company.

- Capital Allocation: Facilitating investors and capital providers in allocating resources efficiently and determining appropriate pricing.

Despite its significance, ESG data often grapples with issues of quality and reliability. However, the ongoing digitization of data collection, coupled with robust ESG data management practices, holds the promise of enhancing data quality and ensuring its seamless usability for any intended purpose.

Despite its significance, ESG data often grapples with issues of quality and reliability. However, the ongoing digitization of data collection, coupled with robust ESG data management practices, holds the promise of enhancing data quality and ensuring its seamless usability for any intended purpose.

Navigating Data Users and Owners

In the realm of ESG data management, roles are delineated between data users and data owners, each playing a crucial part in data utilization and accountability.

- Data Users: They encompass stakeholders, applications, or processes that utilize and rely on data. Their expectations revolve around data suitability for their specific needs and quality standards.

- Data Owners: Individuals responsible for overseeing the meaning, content, quality, and dissemination of a particular dataset. Their duties span data definition, creation, identification, maintenance, delivery, and consumption.

Evaluating Data Quality: The Seven Dimensions

In corporate sustainability data management, ensuring data quality is paramount, albeit challenging due to numerous users and owners. However, adhering to established principles of data quality remains imperative, mirroring standard business data practices.

According to the Enterprise Data Management Council, data quality is evaluated across seven critical dimensions:

- Accuracy: Precision of data, validated against original documents or authoritative sources and aligned with defined business rules.

- Completeness: Presence of all required data attributes within the dataset.

- Conformity: Alignment of data with internal, external, or industry-wide standards.

- Consistency: Agreement of data values, formats, and definitions across different datasets.

- Coverage: Breadth, depth, and availability of data, ensuring no crucial information is missing.

- Timeliness: Alignment of data with current market/business conditions and functional availability when needed.

- Uniqueness: Singularity of records or attributes, aiming for a “single source of truth” in data representation.

Establishing a Unified ESG Data Management System

Sustainability initiatives demand concrete evidence of positive impact, transcending mere rhetoric. This entails setting measurable goals, demonstrating progress, and reporting transparently to an expanding stakeholder community.

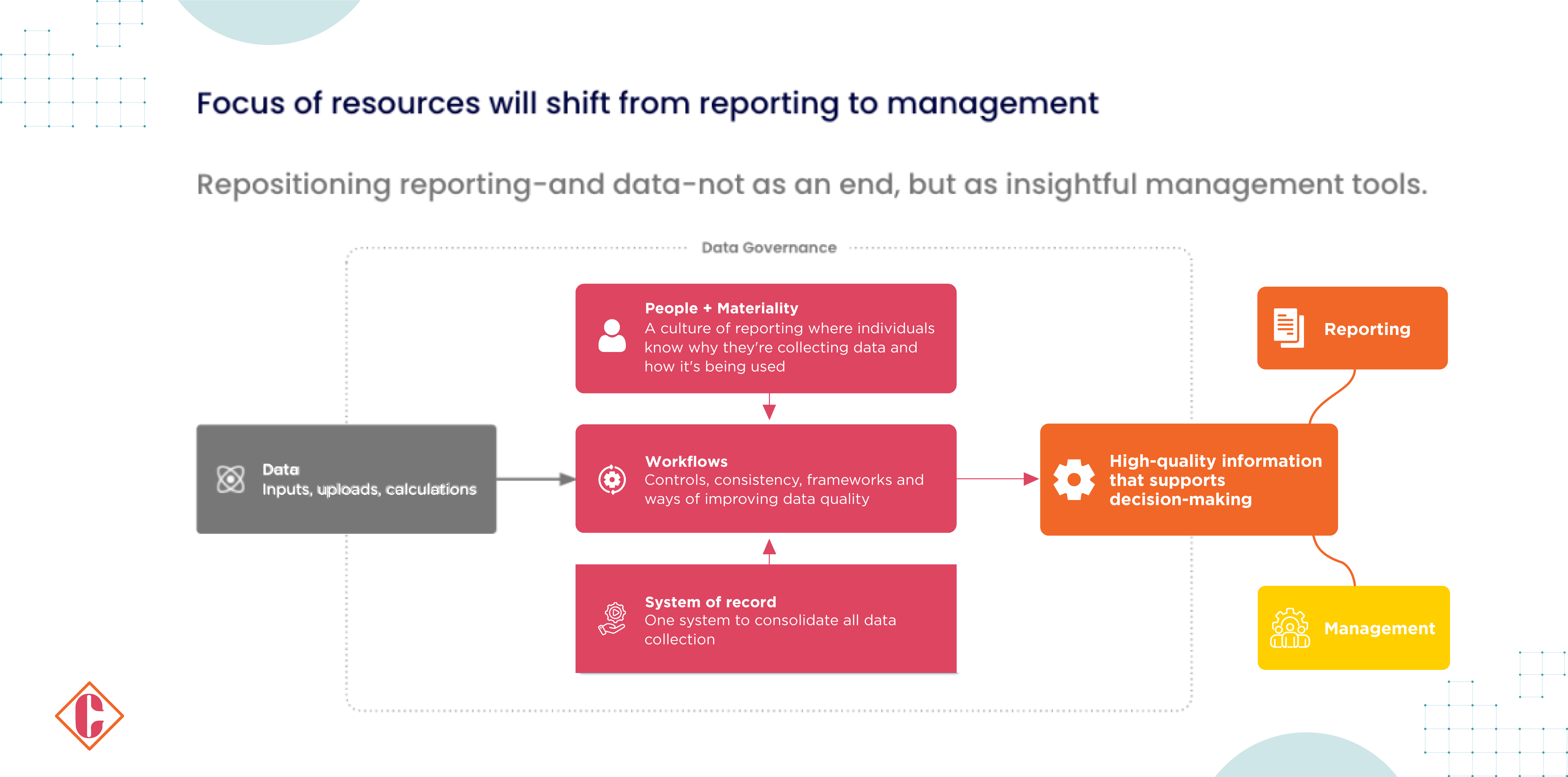

Achieving these objectives necessitates a paradigm shift in environmental, social, and governance (ESG) data management. It mandates consistent data aggregation and robust reporting akin to financial disclosures.

Addressing the Challenge

Organizations grapple with the complexity of ESG data capture, compounded by its diverse nature and dispersion across siloed systems. Spreadsheet-based management, albeit common, proves inadequate, lacking accuracy and transparency.

Just as financial reporting relies on dedicated software, sustainability requires a similar approach. Financial-grade software ensures accurate, transparent, and auditable disclosures, meeting stakeholders’ expectations.

-

ESG Data Foundation:

- ESG data is indispensable for actionable sustainability initiatives. However, its collection poses significant challenges, exacerbated by supply chain data requirements.

- Robust organization and structuring of ESG data are vital for deriving meaningful insights. Spreadsheet-based solutions fall short, lacking scalability and accuracy.

- Dedicated software ensures compliance with stakeholder demands for accuracy, transparency, and auditability.

-

Reporting Sustainability Performance:

- High-stakes sustainability reporting demands financial-grade accuracy, auditability, and comparability over time.

- With multiple reporting frameworks available, organizations must align disclosures with stakeholder expectations and set internal goals for improvement.

-

Choosing an ESG Reporting Framework:

- Frameworks such as the Global Reporting Initiative (GRI), Taskforce on Climate-related Financial Disclosures (TCFD), and Corporate Sustainability Reporting Directive (CSRD) offer guidance for robust, transparent reporting.

-

Setting and Tracking GHG Emissions Targets:

- Many organizations seek to set ambitious goals for reducing greenhouse gas emissions, including achieving carbon neutrality, net zero emissions, or becoming climate-positive.

- Clear goal-setting facilitates progress tracking and motivates action toward mitigating climate impact.

Significance of ESG Data Management

In a corporate landscape transitioning towards inclusivity and sustainability, ESG data management plays a pivotal role. The shift from shareholder to stakeholder capitalism necessitates sustainable practices demanded not only by investors but also by employees and consumers.

Influencing Corporate Decision-Making

Effective ESG data management is indispensable for informed strategic decision-making. It empowers companies to discern risks and opportunities, adapting to a market that increasingly prioritizes transparency and accountability.

Institutions like GRI, SASB, and BCorp have formulated methodologies and global standards guiding companies in fostering data transparency.

Driving Innovation and Leadership

Pioneering sustainability firms constantly innovate in their ESG strategies, leveraging data management to anticipate risks, seize opportunities, and swiftly adapt to regulatory shifts and market expectations.

Specialized ESG data management platforms facilitate this process, enabling companies to make strategic decisions based on accurate and current data.

Long-Term Benefits

ESG data management enhances a company’s credibility and public perception. Transparency, even amid less favorable outcomes, underscores a commitment to continuous improvement, bolstering stakeholder confidence and potentially unlocking funding opportunities.

Challenges and Solutions in ESG Data Management

Businesses recognize the operational and financial benefits of fostering sustainable supply chains. However, they encounter various challenges concerning ESG data, which could distort results, mislead stakeholders, waste resources, and drive poor decisions. These hurdles are influenced by geographical factors, materiality priorities, supply chain complexities, product portfolios, and industry contexts. Nonetheless, the common challenge faced across industries is ensuring the collection and processing of accurate and verifiable data, a task complicated by the historical absence of sustainability data disclosures from regulatory, investment, or consumer perspectives.

Challenges

Data Governance and Storage

Many companies grapple with data silos, whether functionally or in storage, access, analysis, and management. Sustainability data spans numerous systems within organizations, necessitating extraction, consolidation, validation, cleansing, and harmonization to create a cohesive enterprise-wide view. Manual management, often reliant on labor-intensive spreadsheets, extends the process duration, sometimes up to six months. Moreover, assessing a company’s full impact demands acquiring sustainability data from beyond its organizational boundaries, especially relevant for supply chain sustainability performance evaluation.

Data Sharing Challenges

Data movement within the supply chain ecosystem faces constraints due to stakeholders’ reluctance to share ESG data, fearing potential competitive advantages for others. This lack of trust hampers optimal information utilization across the ecosystem. Privacy laws, such as GDPR, further complicate data sharing, as some suppliers perceive their information as proprietary. Mandatory disclosure regulations emerge as a potential solution to enhance transparency and encourage action, as evidenced by proposals like the SEC’s climate change disclosure initiative and the European Commission’s CSRD proposal.

Digitalization, Automation, and Streamlining

As companies embark on digitizing supply chains, integrating sustainability data becomes imperative. Emphasizing accurate data collection, management, storage, and governance is crucial. Leveraging existing platforms for ESG data inclusion enhances accessibility across departments. Digital platforms enable real-time integration of ESG data into decision-making processes, circumventing challenges associated with less frequent reporting intervals. Automation in ESG data management processes offers heightened assurance and efficiency, saving resources, and time, and minimizing errors. Digital supplier collaboration mechanisms facilitate data sharing and enhance end-to-end transparency, complementing stringent disclosure regulations.

Financial institutions (FSI) play a critical role in financing the net zero transition and support companies in becoming more sustainable. They need to scale ESG beyond meeting regulatory requirements to portfolio management and capturing ESG-related opportunities. However, ESG data is scarcely available – posing a

major challenge for FSI. A more holistic and automated approach is required to scale sustainability efforts. – MARIA PATSCHKE, CEO, SAP Fioneer ESG Solutions

Solutions

Utilize a Structured Process and Integrated Infrastructure

This means creating a standardized approach for collecting, storing, and managing ESG data. This can help to ensure that data is consistent, accurate, and complete. It can also make it easier to find and analyze data.

An integrated infrastructure can help to connect different systems and applications that store ESG data. This can make it easier to share data and generate reports.

Here are some additional tips for overcoming ESG data management challenges:

- Define your ESG data needs. What data do you need to collect and manage to meet your ESG goals?

- Identify your data sources. Where is your ESG data coming from?

- Standardize your data collection process. How will you collect your ESG data?

- Implement data quality controls. How will you ensure that your ESG data is accurate and complete?

- Develop a data governance framework. Who is responsible for managing your ESG data?

Optimizing ESG Data Management with the Right Data Infrastructure

To overcome the challenges inherent in ESG data management, selecting the appropriate data infrastructure is paramount. An ESG engine designed for scalability forms the cornerstone, offering a structured framework encompassing methods and models for individual Key Performance Indicators (KPIs). This engine facilitates the creation of a harmonized data model, accommodating all ingested data while possessing the flexibility to evolve.

Additionally, a dedicated Workbench for data orchestration emerges as a pivotal solution, overseeing requirements definition, data integration, and error checking of ingested data. This centralized platform streamlines data processes, ensuring accuracy and efficiency in managing ESG data.

Access to diverse data sources is essential for comprehensive ESG data management. An ESG data marketplace serves as a valuable resource, providing standardized logic for bank-internal systems and access to ESG data vendors. Additionally, support for direct data collection from customers, such as through customer questionnaires, enhances data acquisition, contributing to a robust ESG data ecosystem.

Systematic Sourcing of Granular Proxies

To address ESG data management challenges effectively, implementing a systematic approach to sourcing granular proxies emerges as a strategic solution.

Fallback Logic for Auditable Proxy Data: Defining a fallback logic for auditable proxy data enables the calculation of Key Performance Indicators (KPIs) even in scenarios where counterparty data is unavailable. This ensures continuity in data-driven decision-making processes.

Programmatic Representation of Data Sources: Programmatic representation of data sources is imperative for seamless implementation of the fallback logic throughout the data orchestration process. This structured approach enhances efficiency and accuracy in sourcing and integrating proxy data.

Ensuring PCAF Quality Score Compliance: Guaranteeing the ability to achieve PCAF quality score levels of ≤ 5 without proxy data is crucial. In situations where proxy data is unavailable, manual sourcing is necessary to enhance data quality and ensure compliance with PCAF standards.

Leveraging Proxy Data for Enhanced Calculations: With proxy data available, assurance can be provided for PCAF calculations at intermediate score levels. This facilitates more robust analysis and decision-making processes, contributing to improved ESG performance assessment.

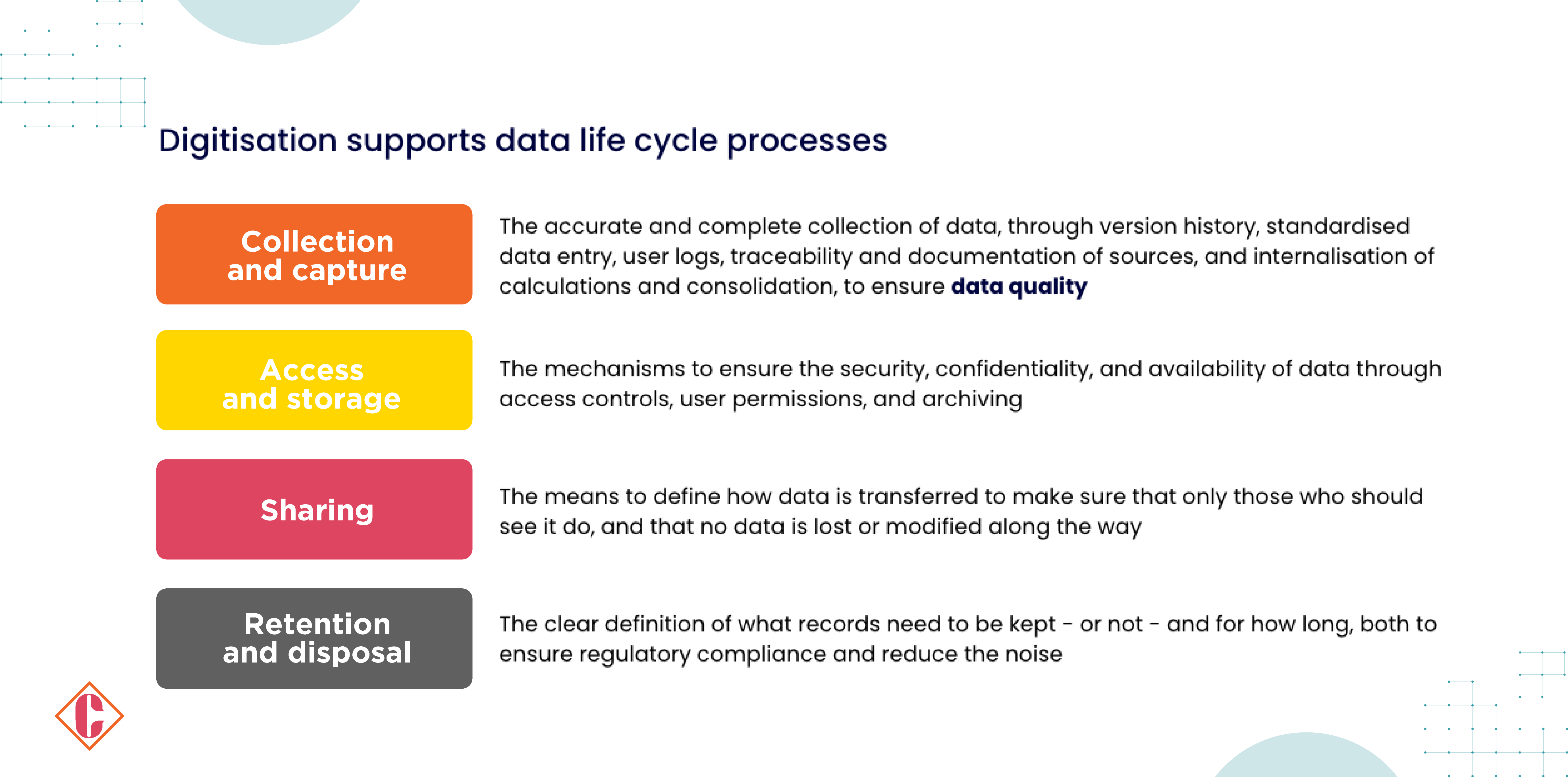

Supporting ESG Data Management through Digitization

Embracing digitization is pivotal in enhancing the quality and efficiency of ESG data management across its lifecycle.

ESG Data Collection and Capture

ESG Data Collection and Capture

Manual data collection, especially concerning non-financial, sustainability-related data, remains prevalent and cumbersome. Automating data ingestion expedites the process while ensuring consistent and high-quality data through validation controls.

ESG Data Access and Storage

Proper access and storage protocols safeguard data integrity, confidentiality, and availability. Digital repositories facilitate easier, faster, and more secure retrieval of ESG data compared to traditional physical repositories.

ESG Data Sharing

Establishing sharing controls and transfer agreements defines data ownership and safeguards confidentiality and integrity during data transfer. Digitizing ESG data allows for centralized access, streamlining sharing processes, and reducing redundancy.

ESG Data Retention vs. Disposal

Effective data management involves defining retention policies to determine the lifespan of data assets. While technology offers increased storage capacity, clear guidelines are necessary to prevent unnecessary data accumulation.

Conclusion

By embracing quality, centralized ESG data and implementing effective ESG data management practices, companies can attain a comprehensive understanding of their sustainability performance. This empowers them to seamlessly share insights with stakeholders and take decisive actions to drive sustainable growth and resilience.

In conclusion, the journey towards sustainability excellence demands a commitment to leveraging digital solutions and fostering a culture of data-driven decision-making. With the right tools and practices in place, organizations can navigate the complexities of ESG data management with confidence, ensuring they are well-positioned to thrive in an ever-evolving business landscape.

FAQs

1. What is ESG data management?

ESG data management refers to the processes and systems used to collect, store, analyze, and report on Environmental, Social, and Governance (ESG) data. This data helps companies track their sustainability performance and impact.

2. Why is ESG data management important?

Investors, stakeholders, and regulators are increasingly demanding transparency and accountability from companies on their ESG performance. Effective data management is crucial for demonstrating progress, identifying risks, and making informed decisions.

3. What are the main challenges of ESG data management?

Several challenges can arise, including:

- Data consistency and quality: Ensuring data accuracy and consistency across different sources and formats.

- Standardization: Aligning with various reporting frameworks and regulations.

- Data integration: Connecting data from various internal and external sources.

- Accessibility and transparency: Providing stakeholders with clear and concise data insights.

- Technology and resources: Selecting and implementing the right tools and personnel.

4. What are some best practices for ESG data management?

Here are some key recommendations:

- Define your ESG goals and data needs.

- Implement a structured data collection and storage process.

- Invest in data quality control measures.

- Utilize technology for automation and integration.

- Establish clear ownership and governance for data management.

- Communicate ESG data transparently to stakeholders.

5. What are the future trends in ESG data management?

Advancements in technology, such as artificial intelligence and blockchain, are expected to play a significant role in:

- Improving data automation and quality.

- Enhancing data security and transparency.

- Facilitating better stakeholder engagement.

- Developing new ESG metrics and reporting standards.

[To share your insights with us as part of editorial or sponsored content, please write to sghosh@martechseries.com]

ESG Data Collection and Capture

ESG Data Collection and Capture